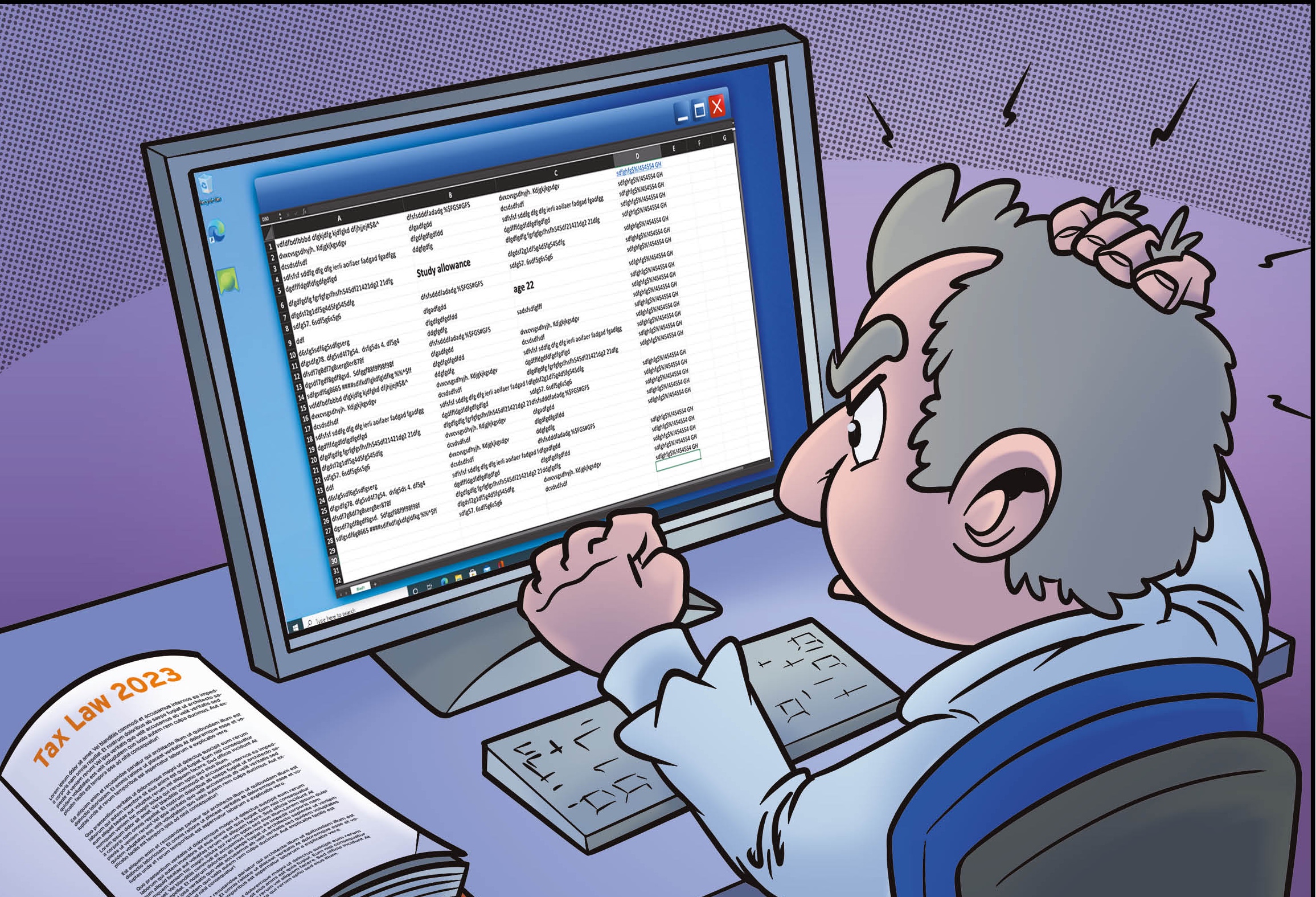

🔍 𝗧𝗵𝗲 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲: Imagine tax lawyers wrestling with generic spreadsheets filled with data, formulas, and references. Their frustration is understandable as they navigate through mostly unreadable text, trying to decode and apply tax laws accurately.

🚀 Unlocking the Power of Domain-Specific Languages in Tax Law 🚀

Navigating the complex world of tax law can be a daunting task for even the most seasoned Subject Matter Expert. The details, regulations, and specific terminologies require precision and understanding that generic tools often fail to provide. This is where the magic of Domain-Specific Languages (DSLs) comes into play.

|

💡 𝗧𝗵𝗲 𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻: DSLs, designed with the specific needs of tax professionals in mind. The collaboration between the SMEs and DSL experts allows for the development of a language specifically tailored to the needs of the experts' workflow, transforming frustration into efficiency. |

|

|

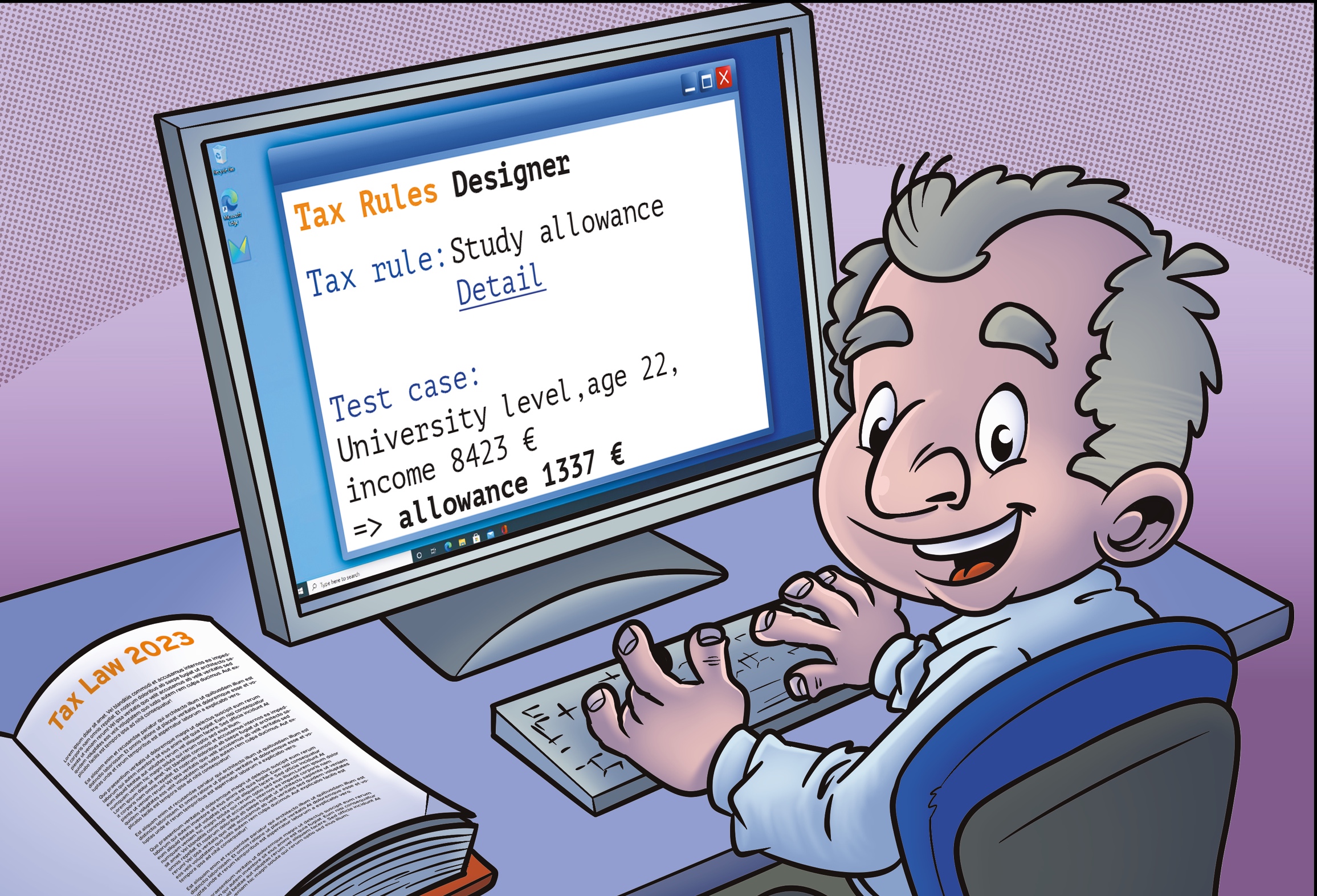

🎉 𝗧𝗵𝗲 𝗢𝘂𝘁𝗰𝗼𝗺𝗲: With these new DSLs, tax lawyers now find themselves empowered in front of their computers. The once complex spreadsheets have transformed into user-friendly interfaces, where tax laws and regulations are seamlessly integrated into their workflow. The details of tax law are no longer barriers but tools at their fingertips. |

|

🌟 Why DSLs?

𝗣𝗿𝗲𝗰𝗶𝘀𝗶𝗼𝗻: Tailored to specific domains, ensuring accuracy in tasks.

𝗘𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝗰𝘆: Streamlines processes, reducing time spent on complex analyses.

𝗔𝗰𝗰𝗲𝘀𝘀𝗶𝗯𝗶𝗹𝗶𝘁𝘆: Makes complex regulations understandable, enhancing decision-making.

The adoption of DSLs in specialized fields is not just an innovation; it’s a necessity. For professionals and visionary teams alike, it can be a game-changer, transforming challenges into opportunities.